car lease tax write off

For example lets say you spent 20000 on a new car for your business in June 2021. There you have it.

How To Write Off A Car Lease For Your Business In 2022

Line 9819 for farming expenses.

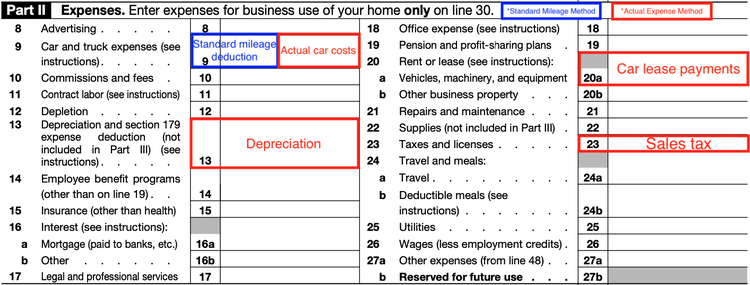

. Using Section 179 to Write Off Luxury Vehicles. If you choose to use actual expenses you can deduct the part of each lease payment that is for the use of the vehicle in your business. Heavy SUVs Vans and Pickups that are more than 50 business-use and exceed 6000 lbs.

If you expect to be leasing a car soon you may also be able to deduct the sales tax on your new car lease the only states with no sales tax are Alaska Delaware Montana New Hampshire or Oregon. To get a depreciation or Section 179 deduction you must use your car more than 50 of the time for business driving. In rare cases it may be lower but in general CRA sets the limits ensure that the level of deductions for leased automobiles is similar to that for purchased ones.

The IRS allows you to deduct these costs over seven years regardless of the length of time that you have owned or leased the vehicle for business purposes. Would leasing be the best option. Coupe sedan station wagon sports car or luxury car.

Pick-up truck with extended cab used to transport goods equipment or passengers. In this case the formula will look like this. So if I lease a car with monthly lease payments being around 450 which yearly accumulates to around 5400 how much of that would I be able to write off on taxes since Im a real estate agent in Canada.

However provided at least half of the cars usage is for business and your company is VAT registered you can claim up to 50. However enrolled agent Eva Rosenberg suggests leasing a car if your planned vehicle will cost in excess of 500 per month because the IRS limits how much you. Since most leased company cars have some degree of personal use you wont always be able to claim back the full amount of tax.

The deduction limit in 2021 is 1050000. This is known as the State And Local Tax SALT deduction which also allows for real estate taxes property taxes and other sales taxes write offs with an annual cap of 10000. There are two methods for figuring car expenses.

On the other hand business leasing allows you to claim back up to 50 of tax on the rentals and up to 100 on a maintenance package. Instead all of these write-offs are included in a standard mileage rate set by the IRS. Line 9281 for business and professional expenses.

Section 179 is a tax strategy that often gets overlooked especially with bonus depreciation at 100. Many people incorrectly assume that car write-offs only extend to cars that you own but the IRS has never made that distinction. Tax write off on a car lease.

You cant deduct any part of a lease payment that is for personal use of the vehicle such as commuting. 800 13 x 181 30 5454. Can you write off a car lease.

But Section 179 is a fantastic strategy to use for long-term tax planning particularly when you purchase or lease luxury vehicles. This would give it an estimated tax write-off of 36765 in year one. A third way to write off a car expenses on your taxes allows you to deduct the expenses over an extended period of time.

Gross vehicle weight can qualify for at least partial Section 179 deduction and bonus depreciation. Here are the qualified vehicles that can get a Section 179 Tax Write-Off. Line 9281 for fishing expenses.

Pick-up truck used to transport goods or equipment. If you claimed your lease payments last year subtract last years amount line 20. You can deduct costs you incur to lease a motor vehicle you use to earn income.

Section 179 allows businesses to deduct the full purchase price of qualifying equipment such as a vehicle bought or financed and put into service sometime during the same tax year. Include these amounts on. Now add GST and PST to 800 and multiply that amount by the total number of days you leased your vehicle during the year and divide the total by 30.

The IRS includes car leases on their list of eligible vehicle tax deductions. When you lease a car through a Personal Contract Hire PCH agreement the monthly price quoted will be inclusive of VAT which will be charged at 20 of the total cost of your agreement. The deduction is based on the portion of mileage used for business.

Many people incorrectly assume that car write-offs only extend to cars that you own but the IRS has never made that distinction. If you lease your car you are able to deduct the monthly lease payments so long as they do not exceed 800 per month plus HST. In 2017 the depreciation limit on a used car was 3600.

When you use a passenger vehicle to earn farming or fishing income there is a limit on the amount of the leasing costs you can deduct. If youre a self-employed person or a business owner who drives for work your lease is fair game. You must spread any advance payments over the entire.

Or should I put money down and finance a vehicle with monthly payments. Before we end this post we have to mention that if you sell your car for a gain then you do have to pay the depreciation back which called depreciation recapture. If you choose to take the standard mileage deduction you cant take any vehicle expenses as a separate write-off.

From IRS publication 463. In 2020 the amount you are eligible for a tax write-off is 575 per mile. If your business is a sole proprietorship filing Schedule C you can deduct mileage expenses for both leased and purchased vehicles.

Pick-up truck other than above Footnote 1. Individuals who own a business or are self-employed and use their vehicle for business may deduct car expenses on their tax return. As a result leasing was almost always a more attractive option for more expensive cars.

If a taxpayer uses the car for both business and personal purposes the expenses must be split. However youll need to qualify for a business lease. If you expect to be leasing a car soon you may also be able to deduct the sales tax on your new car lease the only states with no sales tax are Alaska Delaware Montana New Hampshire or Oregon.

At the end of the year divide your total mileage by 575 and the result will be the amount eligible for a. For 2022 this rate is 0585 for the first half of the year from January to June and 0625 from July onward Youll get to write off that amount for every business mile you drive. However taking all of these recent developments into account Tax Reform has now made buying even used vehicles more attractive than leasing.

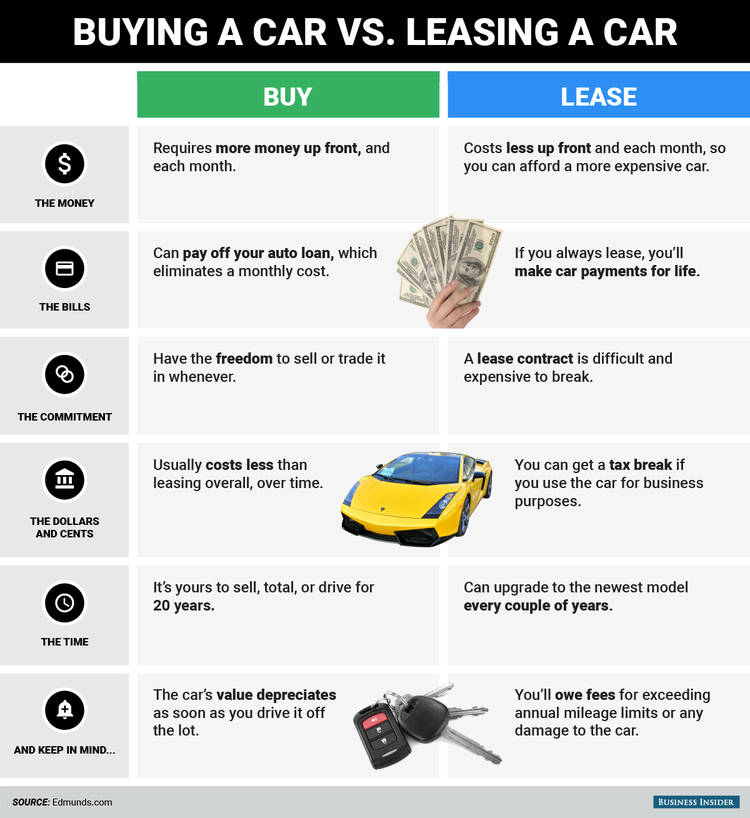

Does Leasing A Car Affect Your Credit Score Debt Com

Is It Better To Buy Or Lease A Car Taxact Blog

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is It Better To Buy Or Lease A Car Taxact Blog

/when-leasing-car-better-buying.asp_final-10bbb582c2f74c2b9c4eafcc6fbab0bd.png)

Pros And Cons Of Leasing Or Buying A Car

Is Your Car Lease A Tax Write Off A Guide For Freelancers

Is It Better To Buy Or Lease A Car Taxact Blog

Writing Off A Car Ultimate Guide To Vehicle Expenses

Is It Better To Buy Or Lease A Car Taxact Blog

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

How Is Car Lease Tax Benefit Calculated In India For Individual Salaried Employee Who Uses The Car For Both Official And Personal Purpose Can You Explain With An Example Quora

Buying Vs Leasing Koons Ford Of Silver Spring Silver Spring Md 2022

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

How To Take A Tax Deduction For The Business Use Of Your Car

Is Buying A Car Tax Deductible Lendingtree

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times